Thanks to recent medical advances, many people survive heart attacks, strokes, and other serious illnesses. But health care costs and inability to work can cause financial stress as income decreases.

USA offers affordable insurance coverage through the workplace. Our Critical Illness insurance policy can reduce the financial impact of a major illness!

Financial Impact: Over half (62.1 percent) of all U.S. bankruptcies are caused by soaring medical bills.* An American Journal of Medicine study states that the average person filing bankruptcy earned a middle-income salary and had health insurance, but was financially crippled by out-of-pocket expenses for co-payments, deductibles, and non-covered medical services.

The USA Critical Illness Solution can reduce the financial impact of a major illness by paying money directly to the primary insured person (employee) when it is most needed. Benefits are provided when an insured person is diagnosed with a specified critical illness or undergoes a covered procedure, even if he or she is unable to work or has other health insurance coverage. Recipients may use the money as they choose—for example, to pay a home mortgage, clear up debt, or supplement family income so a caregiving spouse can take time off from work.

*The American Journal of Medicine, “Medical Bankruptcy in the United States”

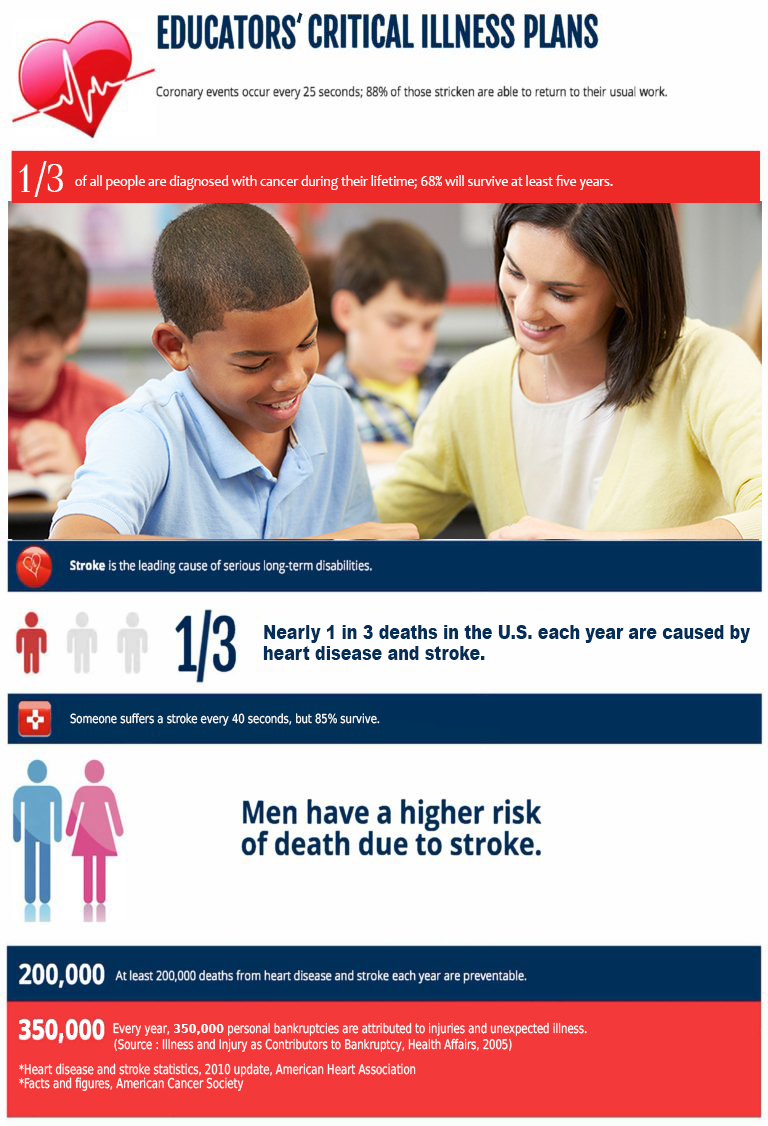

Coronary events occur every 25 seconds; 88% of those stricken are able to return to their usual work.*

Someone suffers a stroke every 40 seconds, but 85% survive.*

One in 3 people are diagnosed with cancer during their lifetime; 68% will survive at least 5 years.**

*Heart disease and stroke statistics, 2010 Update, American Heart Association

*2010 facts and figures, American Cancer Society

Request a Quote

United Schools Associate is insurance that pays you cash directly, to help pay for things that major medical doesn’t cover.

OR

Call Us now at 844.872.4968

*Our products are underwritten by various A.M. Best A-rated companies. Policy riders, availability, features, and rates may vary by state. For cost and details of coverage, please contact United Schools Associates.