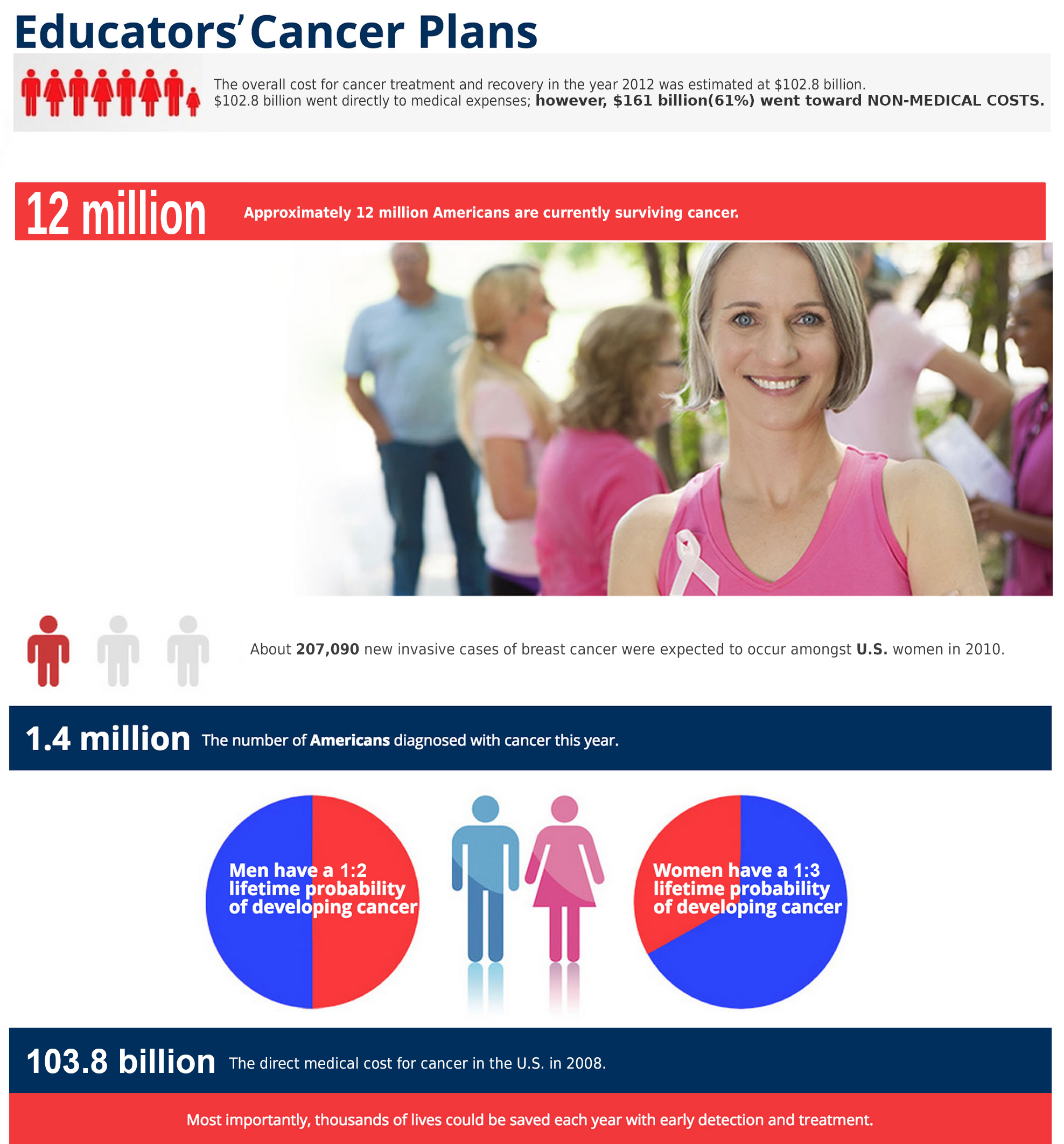

Approximately 12 million Americans are surviving cancer!* Cure rates have climbed steadily due to medical advances, early detection, and preventative care. But treating and living with cancer can be expensive. High health insurance deductibles and co-payments, experimental treatments, prescription prices, travel for treatment, and nursing care can quickly drain the family bank account.

The USA Cancer Expense Solution

USA at Work offers Cancer Expense Insurance, which provides specified benefits for the diagnosis, treatment, and prevention of cancer. This is an indemnity plan that pays over and above any other health insurance benefits, and can help keep cancer expenses from creating a financial crisis. Spouse and child coverage is available, and additional riders can help to further customize cancer coverage.

USA’s Cancer Expense Solution is guaranteed renewable for life, and may be kept in force if an employee leaves their current employer, as long as premiums are paid.

Recent statistics* from the American Cancer Society: 67 percent of cancer patients survive five or more years. Men have a 1 in 2 lifetime probability of developing cancer; women, 1 in 3. The direct medical cost for cancer in the U.S. in 2008 was $103.8 billion.

*American Cancer Society, Cancer Facts and Figures 2012

Request a Quote

United Schools Associate is insurance that pays you cash directly, to help pay for things that major medical doesn’t cover.

OR

Call Us now at 844.872.4968

*Products are underwritten by various A.M. Best A-rated companies. Policy riders, availability, features, and rates may vary by state. For cost and details of coverage, please contact United Schools Associates.